Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

A&Ds in O&G forecast for 2023, trends and factors that influence this

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

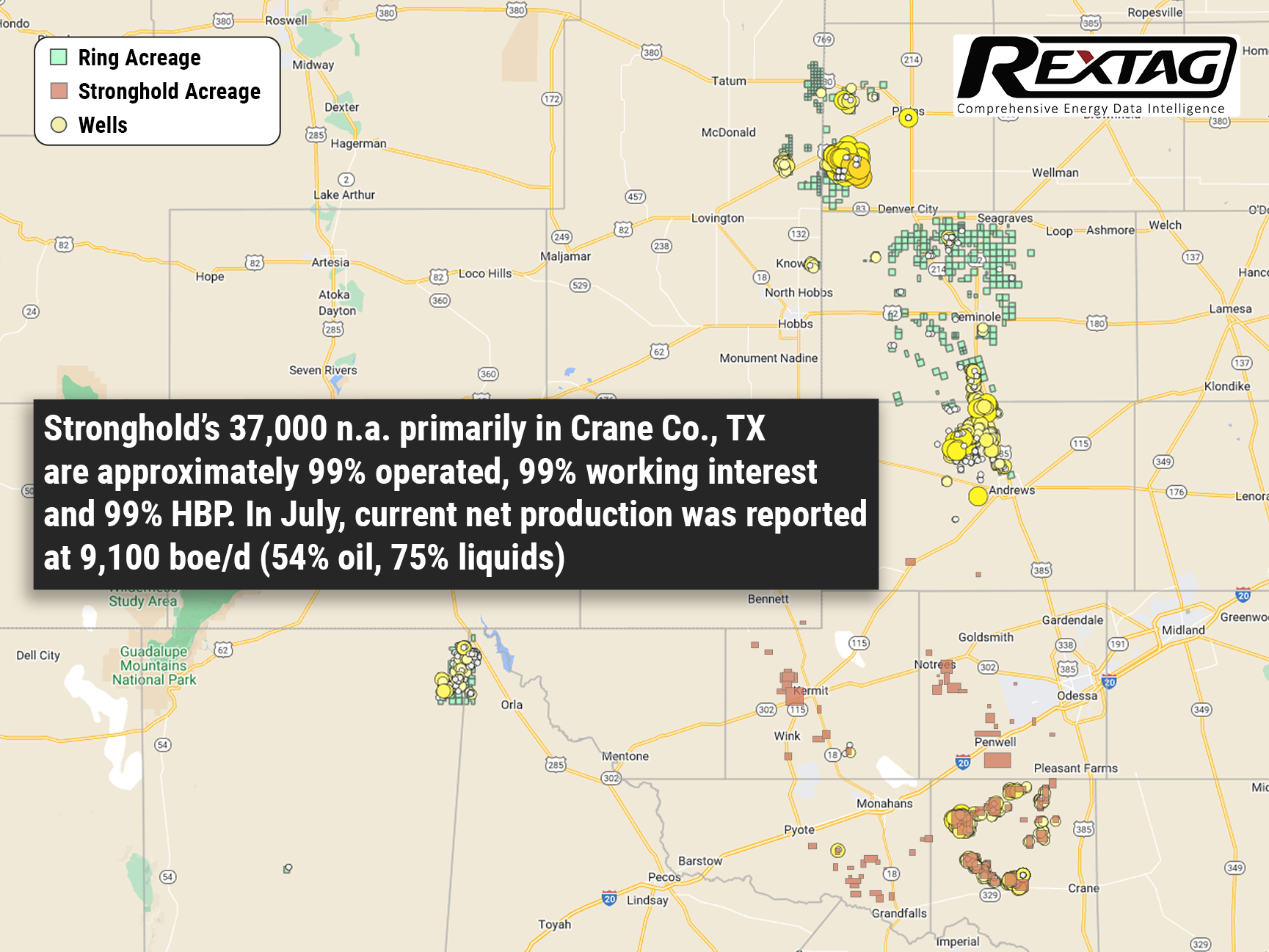

$465 Million for Stronghold Energy; Ring Energy Completes the Acquisition

On August 31 Ring Energy Inc. purchased privately-held Stronghold Energy, adding operations that are mainly situated in Crane County, Texas, in the Permian Basin’s Central Basin Platform. According to a September 1 Ring Energy release, this transaction fully complements the conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin. The majority owned by Warburg Pincus LLC, Stronghold’s operations are concentrated on the development of about 37,000 net acres situated mainly in Crane County. In July Ring Energy entered into an agreement to buy Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP for $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price. Consideration also involved a $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability increasing the total transaction value to $465 million. Stronghold’s asset base is almost 99% operated, 99% working interest, and 99% HBP. In July, Ring announced the current net production of Stronghold’s asset base was approximately 9,100 boe/d (54% oil, 75% liquids).